Markets are getting crushed.

At the moment, the Dow Jones is down another 488 points. The NASDAQ is down 400, as the S&P 500 slips 102. Even the fear gauge, or the VIX is up another 4.38 points. All thanks to the same culprits – the Federal Reserve, sky high inflation, with the 10-year Treasury yield at its highest point since November 2018.

Plus, while the “Federal Reserve announced a 50-basis-point interest rate hike on Wednesday, the central bank’s efforts to combat rising inflation with more aggressive rate raises has also sparked concerns that this could potentially drag on economic growth,” said CNBC.

However, we may soon see a relief rally, if not a bottom, according to the VIX.

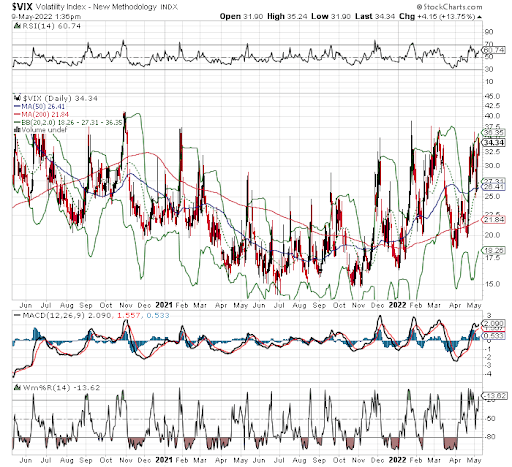

If you pull up a two-year chart of the Volatility Index (VIX), with Bollinger Bands (2.20), RSI, MACD, and Williams’ %R, take a look at the technical history.

About 80% of the time, when the VIX hits or penetrates its upper Bollinger Band, RSI is at its 70-line, MACD becomes over-extended, and Williams’ %R hits or penetrates its 20-line, the VIX historically pulls back. As it pulls back, the broader market tends to bounce back, as well.

We’re currently watching for the hoped-for reversal in the VIX, so we can go bargain hunting.