Whales with a lot of money to spend have taken a noticeably bearish stance on Dell Technologies.

Looking at options history for Dell Technologies (NYSE:DELL) we detected 14 trades.

If we consider the specifics of each trade, it is accurate to state that 35% of the investors opened trades with bullish expectations and 57% with bearish.

From the overall spotted trades, 12 are puts, for a total amount of $1,499,655 and 2, calls, for a total amount of $64,000.

What’s The Price Target?

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $105.0 to $142.0 for Dell Technologies over the recent three months.

Volume & Open Interest Development

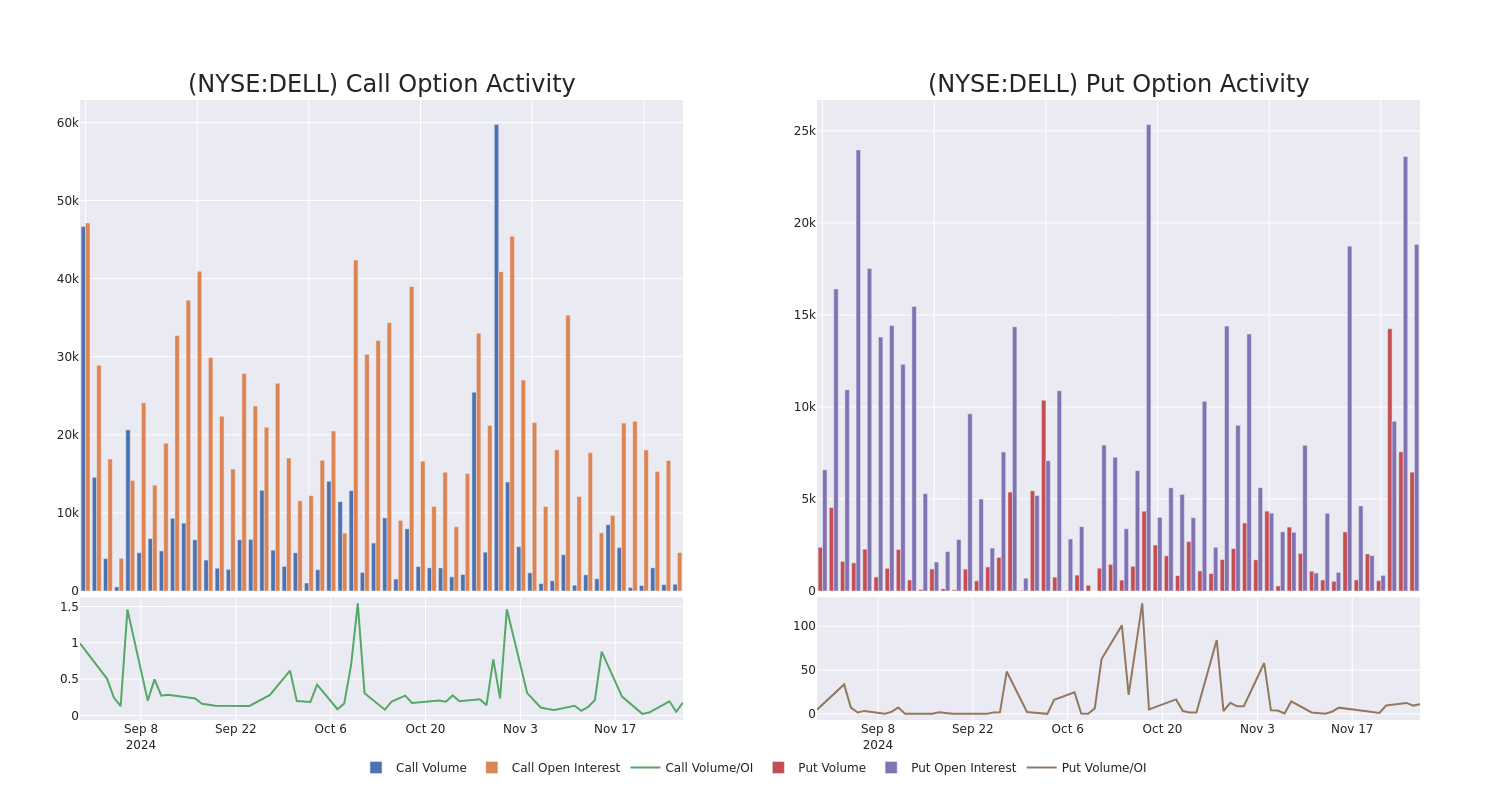

In terms of liquidity and interest, the mean open interest for Dell Technologies options trades today is 2159.91 with a total volume of 7,329.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Dell Technologies’s big money trades within a strike price range of $105.0 to $142.0 over the last 30 days.

Dell Technologies Option Activity Analysis: Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DELL | PUT | TRADE | BULLISH | 11/29/24 | $15.7 | $15.25 | $15.42 | $139.00 | $447.1K | 551 | 389 |

| DELL | PUT | SWEEP | BEARISH | 11/29/24 | $5.4 | $4.8 | $4.85 | $130.00 | $362.1K | 7.2K | 964 |

| DELL | PUT | SWEEP | BEARISH | 11/29/24 | $13.8 | $13.6 | $13.6 | $138.00 | $287.9K | 1.4K | 755 |

| DELL | PUT | SWEEP | NEUTRAL | 12/06/24 | $14.0 | $13.95 | $13.95 | $138.00 | $93.6K | 99 | 450 |

| DELL | PUT | SWEEP | BULLISH | 12/06/24 | $14.0 | $13.85 | $13.85 | $138.00 | $76.1K | 99 | 450 |

About Dell Technologies

Dell Technologies is a broad information technology vendor, primarily supplying hardware to enterprises. It is focused on premium and commercial personal computers and enterprise on-premises data center hardware. It holds top-three market shares in its core markets of personal computers, peripheral displays, mainstream servers, and external storage. Dell has a robust ecosystem of component and assembly partners, and also relies heavily on channel partners to fulfill its sales.

In light of the recent options history for Dell Technologies, it’s now appropriate to focus on the company itself. We aim to explore its current performance.

Present Market Standing of Dell Technologies

- Trading volume stands at 10,234,789, with DELL’s price down by -12.34%, positioned at $124.25.

- RSI indicators show the stock to be is currently neutral between overbought and oversold.

- Earnings announcement expected in 92 days.

What The Experts Say On Dell Technologies

A total of 4 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $144.75.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from Barclays has decided to maintain their Equal-Weight rating on Dell Technologies, which currently sits at a price target of $115.

* Reflecting concerns, an analyst from Evercore ISI Group lowers its rating to Outperform with a new price target of $150.

* An analyst from Morgan Stanley has decided to maintain their Overweight rating on Dell Technologies, which currently sits at a price target of $154.

* Maintaining their stance, an analyst from Wells Fargo continues to hold a Overweight rating for Dell Technologies, targeting a price of $160.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Dell Technologies with Benzinga Pro for real-time alerts.