During times of turbulence and uncertainty in the markets, many investors turn to dividend-yielding stocks. These are often companies that have high free cash flows and reward shareholders with a high dividend payout.

Benzinga readers can review the latest analyst takes on their favorite stocks by visiting Analyst Stock Ratings page. Traders can sort through Benzinga’s extensive database of analyst ratings, including by analyst accuracy.

Below are the ratings of the most accurate analysts for three high-yielding stocks in the health care sector.

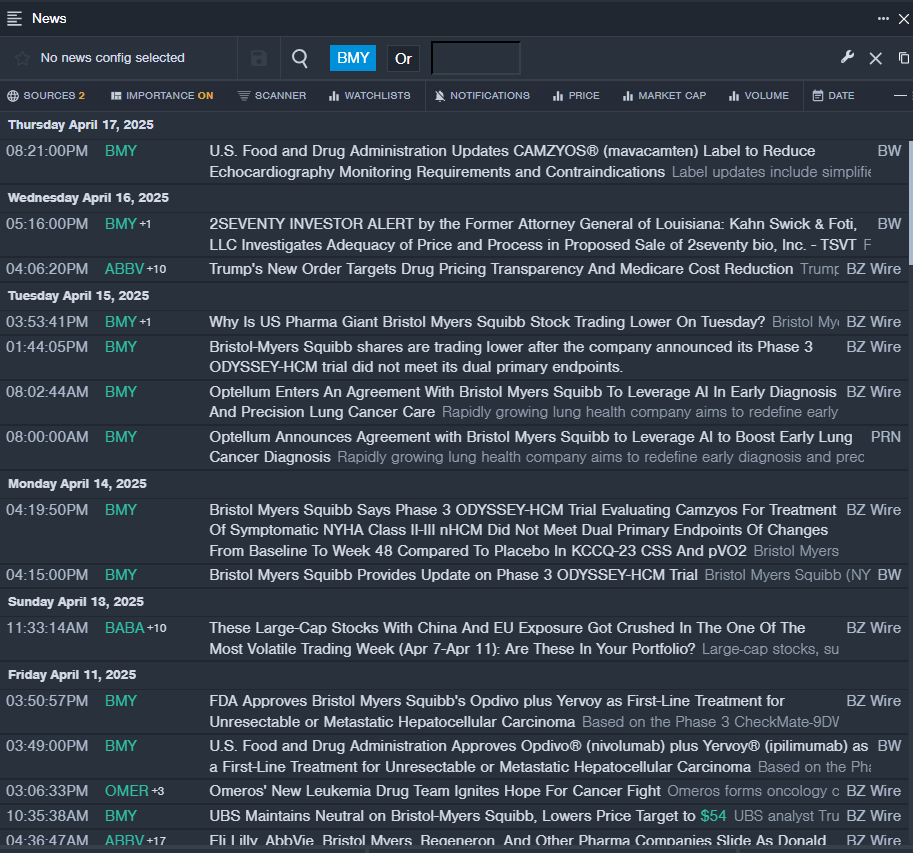

Bristol-Myers Squibb Company (NYSE:BMY)

- Dividend Yield: 5.04%

- UBS analyst Trung Huynh maintained a Neutral rating and cut the price target from $60 to $54 on April 11, 2025. This analyst has an accuracy rate of 64%.

- Wells Fargo analyst Mohit Bansal maintained an Equal-Weight rating and raised the price target from $60 to $62 on Feb. 7, 2025. This analyst has an accuracy rate of 69%.

- Recent News: On April 14, Bristol Myers Squibb announced topline data from the Phase 3 ODYSSEY-HCM trial of Camzyos (mavacamten) for symptomatic New York Heart Association (NYHA) class II-III non-obstructive hypertrophic cardiomyopathy (nHCM).

- Benzinga Pro’s real-time newsfeed alerted to latest BMY news.

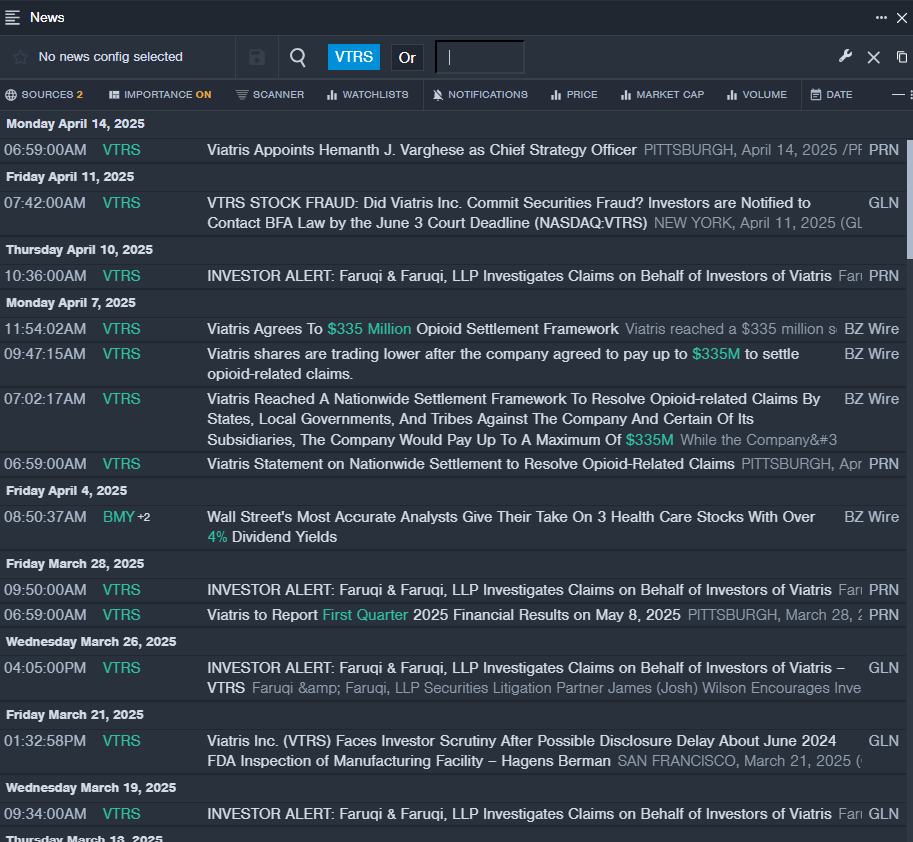

Viatris Inc. (NASDAQ:VTRS)

- Dividend Yield: 6.35%

- Piper Sandler analyst David Amsellem reiterated a Neutral rating and cut the price target from $14 to $10 on March 5, 2025. This analyst has an accuracy rate of 69%.

- B of A Securities analyst Jason Gerberry maintained an Underperform rating and lowered the price target from $11 to $10 on Feb. 28, 2025. This analyst has an accuracy rate of 61%.

- Recent News: On April 14, Viatris named Hemanth J. Varghese as Chief Strategy Officer.

- Benzinga Pro’s real-time newsfeed alerted to latest VTRS news

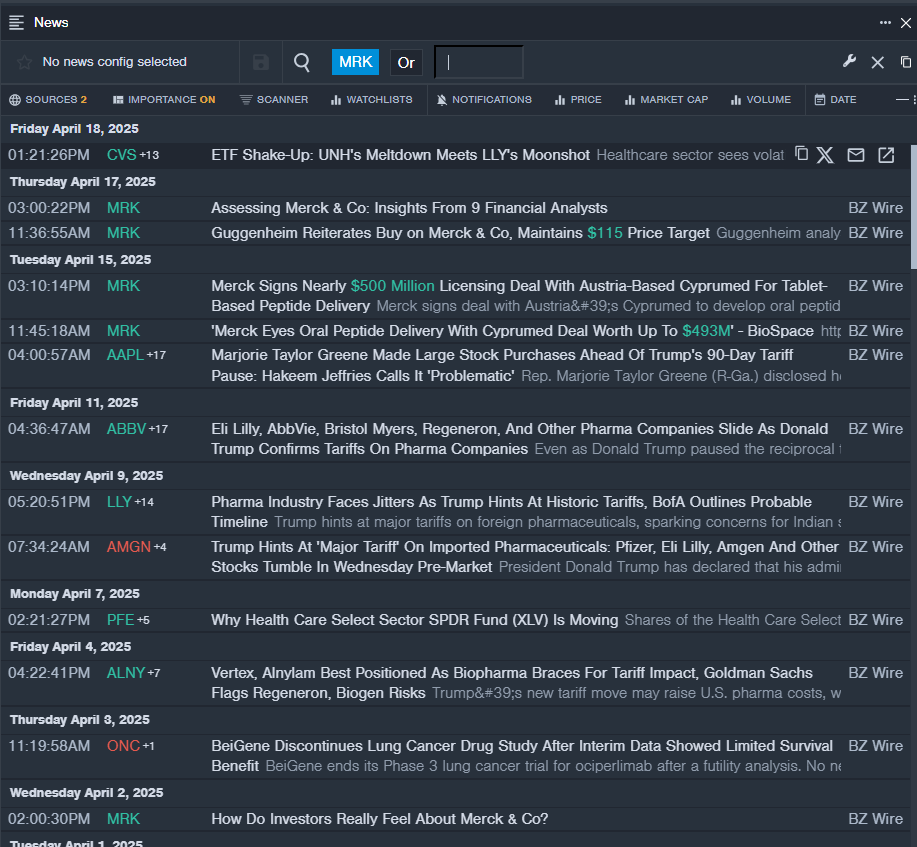

Merck & Co., Inc. (NYSE:MRK)

- Dividend Yield: 4.15%

- Guggenheim analyst Vamil Divan reiterated a Buy rating with a price target of $115 on April 17, 2025. This analyst has an accuracy rate of 74%.

- Citigroup analyst Andrew Baum maintained a Buy rating and cut the price target from $125 to $115 on Feb. 5, 2025. This analyst has an accuracy rate of 70%.

- Recent News: On April 15, Merck and privately held Cyprumed GmbH signed a non-exclusive license and option agreement on Tuesday to develop oral formulations of Merck’s peptides using Cyprumed’s drug delivery technology.

- Benzinga Pro’s real-time newsfeed alerted to latest MRK news

Read More:

Photo via Shutterstock