During times of turbulence and uncertainty in the markets, many investors turn to dividend-yielding stocks. These are often companies that have high free cash flows and reward shareholders with a high dividend payout.

Benzinga readers can review the latest analyst takes on their favorite stocks by visiting Analyst Stock Ratings page. Traders can sort through Benzinga’s extensive database of analyst ratings, including by analyst accuracy.

Below are the ratings of the most accurate analysts for three high-yielding stocks in the health care sector.

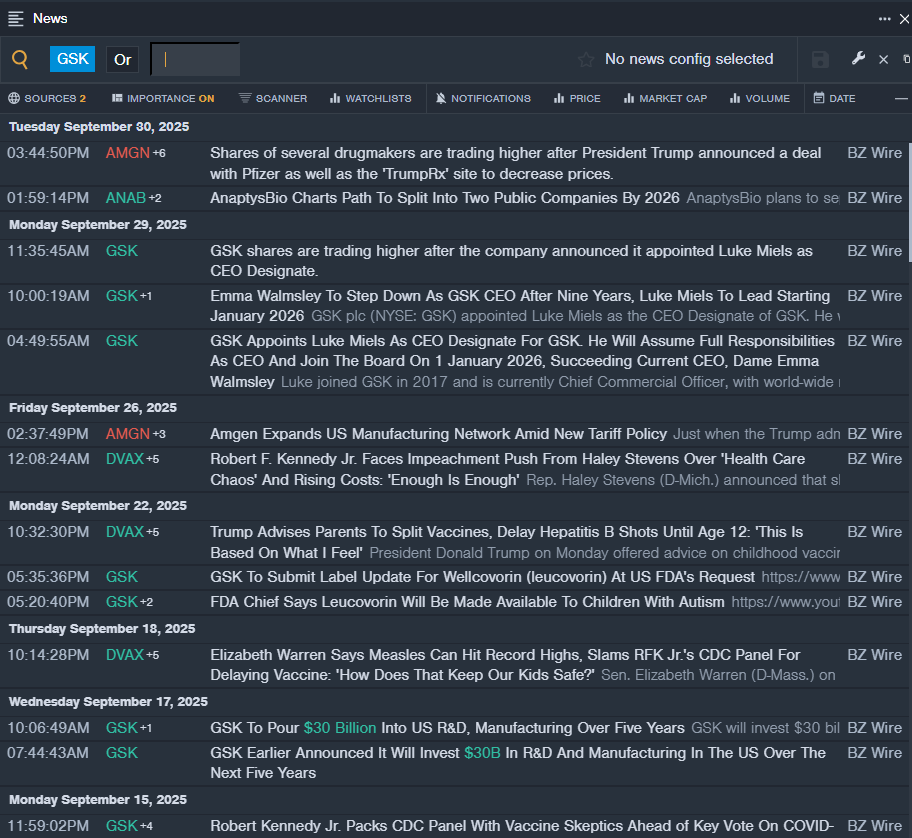

GSK plc (NYSE:GSK)

- Dividend Yield: 4.13%

- Jefferies analyst Peter Welford downgraded the stock from Buy to Hold on Nov. 12, 2024. This analyst has an accuracy rate of 57%.

- Guggenheim analyst Seamus Fernandez downgraded the stock from Buy to Neutral on Oct. 31, 2024. This analyst has an accuracy rate of 73%.

- Recent News: On Sept. 29, GSK appointed Luke Miels as the CEO Designate of GSK. He will assume full responsibility as CEO and join the Board on Jan. 1, 2026.

- Benzinga Pro’s real-time newsfeed alerted to latest GSK news.

DENTSPLY SIRONA Inc (NASDAQ:XRAY)

- Dividend Yield: 5.04%

- UBS analyst Kevin Caliendo maintained a Buy rating and cut the price target from $25 to $24 on Aug. 8, 2025. This analyst has an accuracy rate of 67%.

- Stifel analyst Jonathan Block maintained a Hold rating and slashed the price target from $19 to $17 on Aug. 8, 2025. This analyst has an accuracy rate of 71%.

- Recent News: On Sept. 8, DENTSPLY SIRONA decided to retain Wellspect Healthcare after strategic review.

- Benzinga Pro’s real-time newsfeed alerted to latest XRAY news

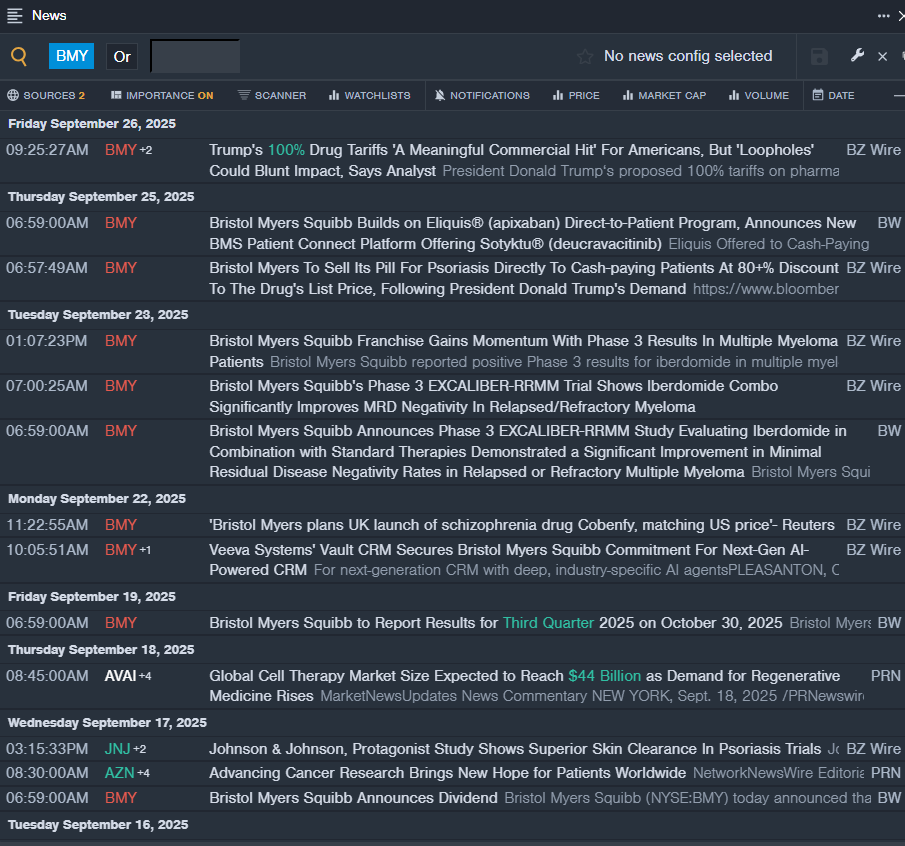

Bristol-Myers Squibb Company (NYSE:BMY)

- Dividend Yield: 5.62%

- Citigroup analyst Andrew Baum maintained a Neutral rating and cut the price target from $51 to $47 on Aug. 1, 2025. This analyst has an accuracy rate of 69%.

- Morgan Stanley analyst Terence Flynn maintained an Underweight rating and slashed the price target from $36 to $34 on July 10, 2025. This analyst has an accuracy rate of 63%.

- Recent News: On Sept. 23, Bristol Myers Squibb announced results from the Phase 3 EXCALIBER-RRMM study evaluating iberdomide, an investigational cereblon E3 ligase modulator (CELMoD), combined with standard therapies (daratumumab + dexamethasone) in patients with relapsed or refractory multiple myeloma (RRMM).

- Benzinga Pro’s real-time newsfeed alerted to latest BMY news

Photo via Shutterstock