Gold and tech stocks—the world’s oldest safe haven and its most speculative growth engine—are surprisingly rising in tandem, defying decades of market logic and setting the stage for what could be an inevitable break.

The precious metal has soared more than 60% in 2025—its best yearly gain since 1979—yet what’s startling is not just the magnitude of the rally, but that it’s been matched by robust gains from the tech-heavy Nasdaq 100.

Gold Vs. Nasdaq 100: An Unusual High And Positive Correlation

Gold and tech stocks aren’t supposed to move hand-in-hand.

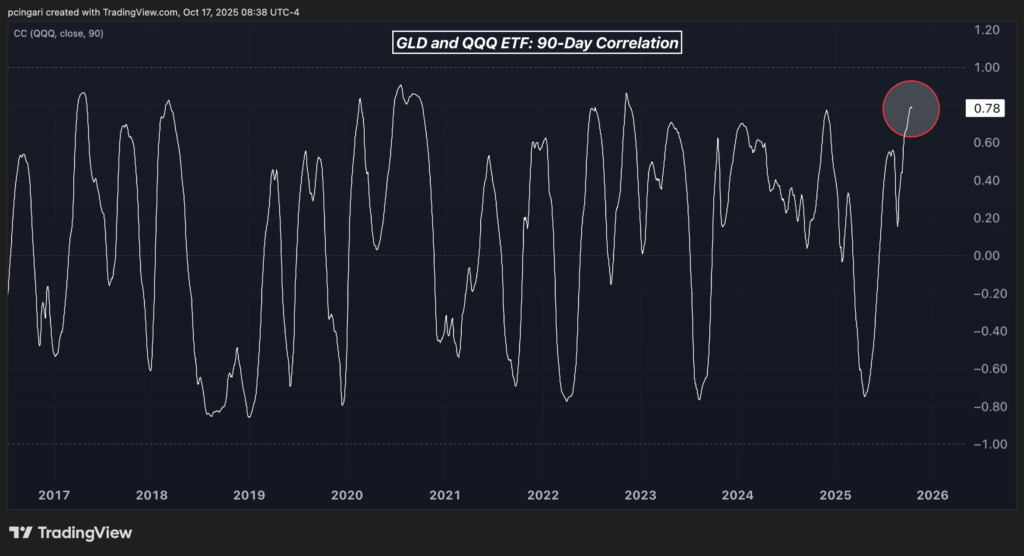

Yet, over the last 90 days, the correlation between the Nasdaq 100 – as tracked by the Invesco QQQ Trust (NASDAQ:QQQ) and gold prices – tracked by the SPDR Gold Shares (NYSE:GLD) surged to 0.78, or 78%—a level that far exceeds historical averages and the highest recorded since November 2022.

That means gold, traditionally a safe-haven asset, and tech stocks, typically a high-risk bet, have moved almost in lockstep over the past few months.

In fact, following President Donald Trump‘s tariff-induced market selloff in April, both gold and tech stocks have climbed by roughly 45% as of Friday.

Historically, such strong positive correlations between gold and tech are anomalies and tend to be short-lived.

In other words, when two assets that are typically considered opposites—one a haven in times of distress, the other a risk-on growth play—begin moving in tandem, history warns that this alignment usually ends with one faltering.

Chart: Gold And Tech Have Risen In Sync, But History Shows The Marriage Is Short Lived

Why Are Gold and Tech Rising Together In 2025?

Several macroeconomic and political forces have driven both gold and tech higher this year, despite their conflicting roles in financial markets.

Gold’s record-breaking rally in 2025 is the result of a perfect storm of macroeconomic risks. Central banks have ramped up gold purchases, and this has driven a resurgence in global demand.

At the same time, emerging economies are accelerating de-dollarization efforts as they shift reserves away from the U.S. dollar. Investor inflows into gold-backed exchange-traded funds have surged, reflecting a growing appetite for portfolio hedges.

Meanwhile, unease over President Trump’s tariff agenda and his pressure on the Federal Reserve has added to the flight toward safe havens.

The Nasdaq 100 has climbed 17% year-to-date, bolstered by strong earnings and unrelenting investor enthusiasm for artificial intelligence.

Yet, nearly 70% of the index gains are concentrated in just seven mega-cap stocks, indicating an extreme level of performance concentration.

| Stock | Return | Weight | Contribution (basis points) |

|---|---|---|---|

| Nvidia Corp. (NASDAQ:NVDA) | +35.4% | 9.64% | +298bp |

| Broadcom Inc. (NASDAQ:AVGO) | +53.8% | 6.01% | +249bp |

| Microsoft Corp. (NYSE:MSFT) | +22.0% | 8.30% | +177bp |

| Palantir Technologies Inc. (NASDAQ:PLTR) | +135.5% | 2.17% | +148bp |

| Advanced Micro Devices Inc. (NASDAQ:AMD) | +94.2% | 2.04% | +117bp |

| Alphabet Inc. (NASDAQ:GOOGL) | +33.2% | 6.2% | +181bp |

| Micron Technology Inc. (NASDAQ:MU) | +141.3% | 1.22% | +84bp |

Is This Correlation Sustainable?

Not likely. Gold and tech represent fundamentally different investment theses.

Gold is a non-yielding asset prized for its stability in times of economic or geopolitical risk. It rises when investors fear inflation, deflation, or monetary policy dysfunction—conditions often associated with economic stress.

Tech stocks, by contrast, thrive on growth optimism, innovation cycles, and earnings momentum. They are highly sensitive to interest rates and investor risk appetite.

Historically, whenever gold and tech correlations spike into positive territory, it hasn’t lasted. Similar patterns occurred in November 2022, summer 2020, and April 2017—each time followed by a sharp divergence.

Who Breaks First—Gold or Tech?

The current dynamic signals a market out of balance. When two assets with such opposing roles in the financial ecosystem move together, it usually marks a turning point.

Whether the break will come from a reversal in tech sentiment—perhaps due to overvaluations or softening AI demand—or a cooling in gold due to easing macro risks, remains to be seen.

Whether it’s fear or greed that breaks first, history tells us one thing: this strange rally won’t hold for long.

Read Next:

Image created using artificial intelligence via DALL-E.