Whales with a lot of money to spend have taken a noticeably bullish stance on Tesla.

Looking at options history for Tesla (NASDAQ:TSLA) we detected 632 trades.

If we consider the specifics of each trade, it is accurate to state that 43% of the investors opened trades with bullish expectations and 39% with bearish.

From the overall spotted trades, 77 are puts, for a total amount of $4,153,860 and 555, calls, for a total amount of $40,893,816.

What’s The Price Target?

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $350.0 to $960.0 for Tesla during the past quarter.

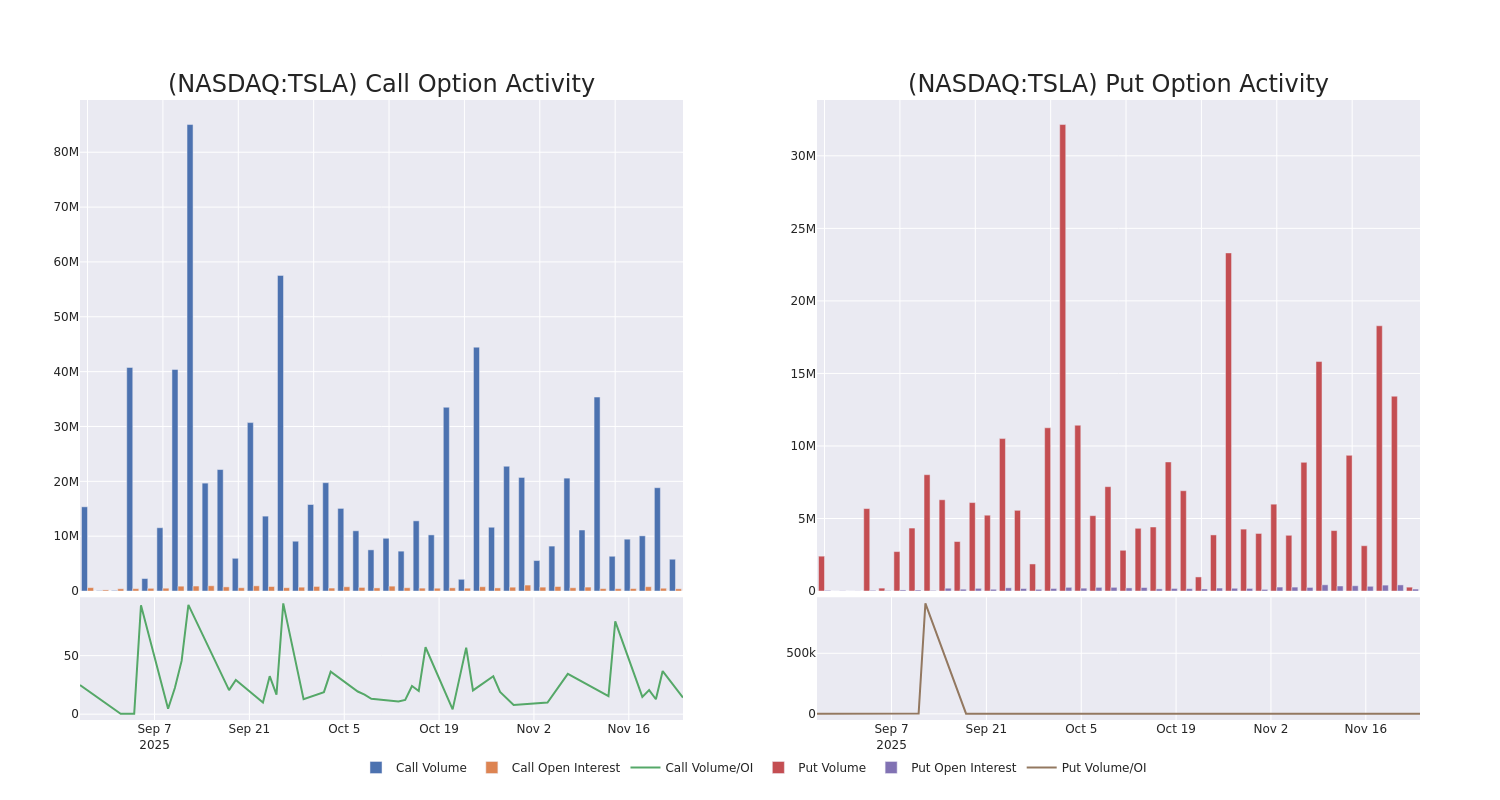

Volume & Open Interest Trends

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Tesla’s options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Tesla’s whale activity within a strike price range from $350.0 to $960.0 in the last 30 days.

Tesla Option Activity Analysis: Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| TSLA | CALL | SWEEP | BEARISH | 11/28/25 | $11.4 | $11.25 | $11.36 | $410.00 | $240.9K | 15.0K | 31.1K |

| TSLA | CALL | SWEEP | BULLISH | 11/28/25 | $3.45 | $3.35 | $3.45 | $430.00 | $120.0K | 9.7K | 13.0K |

| TSLA | CALL | SWEEP | BULLISH | 11/28/25 | $11.55 | $11.45 | $11.45 | $410.00 | $118.4K | 15.0K | 32.1K |

| TSLA | CALL | SWEEP | BULLISH | 11/28/25 | $8.9 | $8.8 | $8.83 | $415.00 | $118.1K | 7.5K | 14.9K |

| TSLA | CALL | SWEEP | BULLISH | 11/28/25 | $7.05 | $7.0 | $7.05 | $420.00 | $107.6K | 14.3K | 30.3K |

About Tesla

Tesla is a vertically integrated battery electric vehicle automaker and developer of real world artificial intelligence software, which includes autonomous driving and humanoid robots. The company has multiple vehicles in its fleet, which include luxury and midsize sedans, crossover SUVs, a light truck, and a semi truck. Tesla also plans to begin selling a sports car and offer a robotaxi service. Global deliveries in 2024 were a little below 1.8 million vehicles. The company sells batteries for stationary storage for residential and commercial properties including utilities and solar panels and solar roofs for energy generation. Tesla also owns a fast-charging network and an auto insurance business.

In light of the recent options history for Tesla, it’s now appropriate to focus on the company itself. We aim to explore its current performance.

Tesla’s Current Market Status

- Currently trading with a volume of 12,138,000, the TSLA’s price is up by 4.47%, now at $408.56.

- RSI readings suggest the stock is currently is currently neutral between overbought and oversold.

- Anticipated earnings release is in 65 days.

What Analysts Are Saying About Tesla

4 market experts have recently issued ratings for this stock, with a consensus target price of $544.75.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* Reflecting concerns, an analyst from Wedbush lowers its rating to Outperform with a new price target of $600.

* An analyst from Stifel has decided to maintain their Buy rating on Tesla, which currently sits at a price target of $508.

* An analyst from Wedbush has revised its rating downward to Outperform, adjusting the price target to $600.

* Maintaining their stance, an analyst from B of A Securities continues to hold a Neutral rating for Tesla, targeting a price of $471.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Tesla, Benzinga Pro gives you real-time options trades alerts.