By Joe Cash

BEIJING (Reuters) – China adjusted its framework for weighing debt sustainability of countries in its Belt and Road Initiative, beefing up criteria to assess the economic growth of borrowers, while dropping positive phrasing about the efforts of multilateral lenders.

The previous guidelines date from 2019, before indebted nations such as Sri Lanka and Zambia defaulted on their loans and appealed to Beijing to restructure their debts.

The new guidelines, released after this week’s third Belt and Road Forum, halve to 10 years the time Chinese financial institutions and those of other BRI nations “are encouraged” to use in making macroeconomic projections, leading to a more prudent approach in assessing growth risks.

The changes also broaden the guidelines to “BRI market access countries” in the programme from just “BRI low-income countries”, boosting eligibility to use Beijing’s preferred framework when seeking financial support.

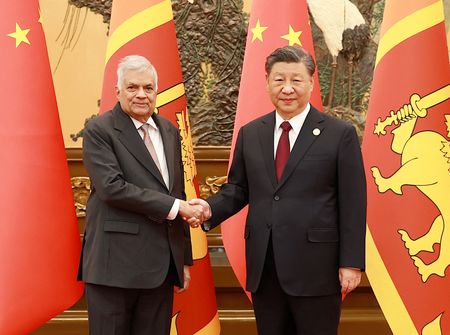

Expanding this definition should bring into the fold “middle-income” countries such as crisis-hit Sri Lanka, which has been seeking debt restructuring assurances from China similar to those available to “low-income” countries via the G20-led Common Framework.

The world’s largest bilateral creditor, Beijing has long wanted multilateral lenders such as the International Monetary Fund and World Bank to share with it their debt sustainability analyses of those seeking debt restructuring, if they expect China to offer debt relief.

China’s loans to lower and middle-income countries were worth $170 billion by the end of 2020, World Bank data shows.

The guidelines also drop a clause “welcoming the efforts of the IMF, World Bank other international institutions to improve debt sustainability of the low-income countries”.

Instead they now urge all BRI countries to adopt the new framework, suggesting Beijing wants to continue talks with debtor nations on a two-way basis, despite the Common Framework’s aim to standardise access to debt relief.

(Reporting by Joe Cash; Editing by Clarence Fernandez)