Investors with a lot of money to spend have taken a bullish stance on Affirm Holdings (NASDAQ:AFRM).

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with AFRM, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga‘s options scanner spotted 14 uncommon options trades for Affirm Holdings.

This isn’t normal.

The overall sentiment of these big-money traders is split between 50% bullish and 42%, bearish.

Out of all of the special options we uncovered, 4 are puts, for a total amount of $192,150, and 10 are calls, for a total amount of $407,955.

Projected Price Targets

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $30.0 and $65.0 for Affirm Holdings, spanning the last three months.

Insights into Volume & Open Interest

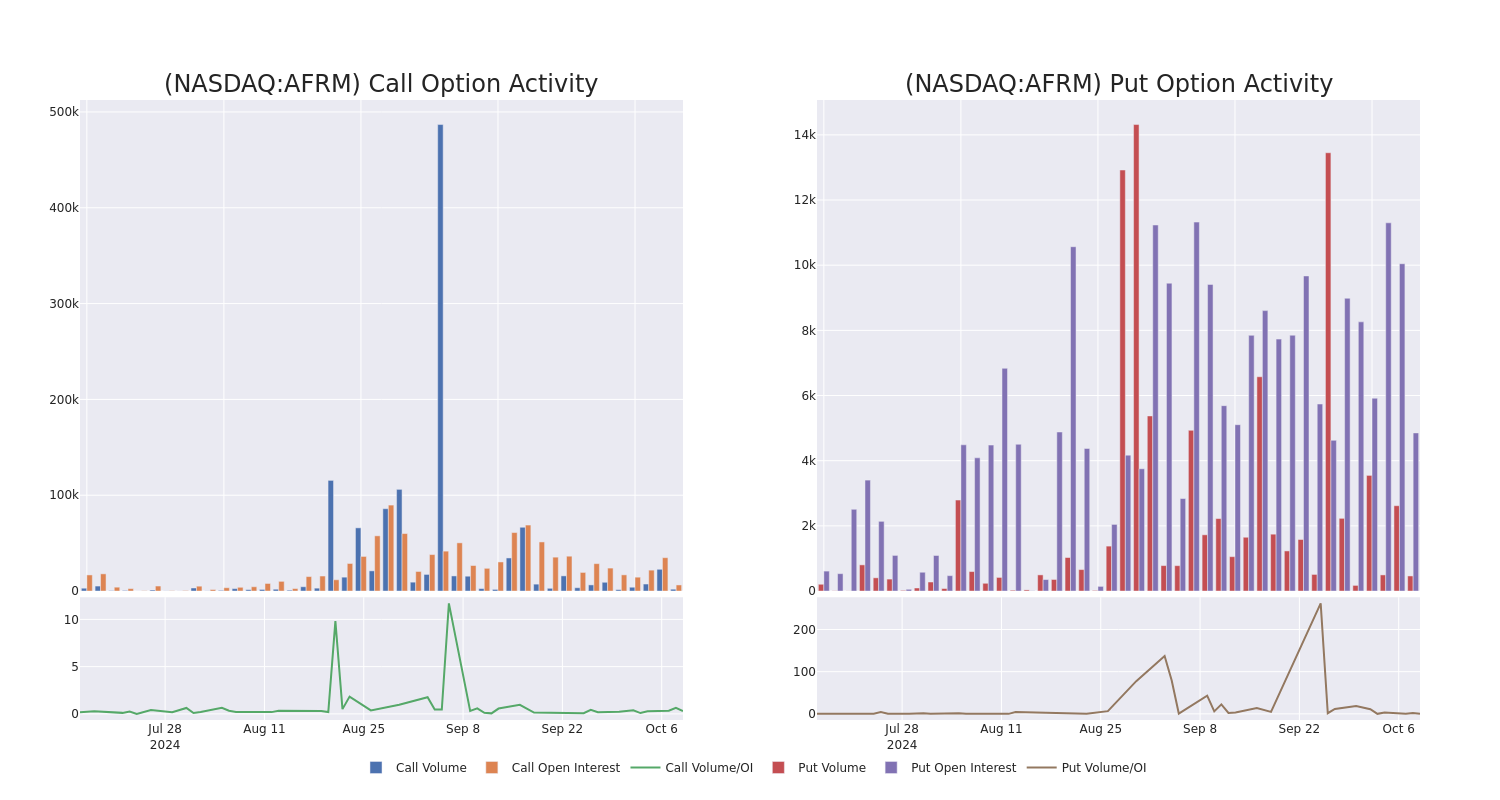

In today’s trading context, the average open interest for options of Affirm Holdings stands at 862.38, with a total volume reaching 2,375.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Affirm Holdings, situated within the strike price corridor from $30.0 to $65.0, throughout the last 30 days.

Affirm Holdings 30-Day Option Volume & Interest Snapshot

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| AFRM | CALL | TRADE | BEARISH | 09/19/25 | $19.5 | $18.85 | $18.85 | $30.00 | $94.2K | 101 | 50 |

| AFRM | PUT | TRADE | NEUTRAL | 11/15/24 | $3.05 | $2.95 | $3.0 | $40.00 | $90.0K | 1.9K | 333 |

| AFRM | CALL | TRADE | BULLISH | 05/16/25 | $6.1 | $6.05 | $6.1 | $52.50 | $73.2K | 3 | 0 |

| AFRM | PUT | SWEEP | BULLISH | 11/15/24 | $0.76 | $0.58 | $0.58 | $30.00 | $40.6K | 1.6K | 0 |

| AFRM | CALL | TRADE | BULLISH | 10/11/24 | $1.92 | $1.69 | $1.9 | $41.50 | $38.0K | 1.6K | 534 |

About Affirm Holdings

Affirm Holdings Inc offers a platform for digital and mobile-first commerce. It comprises a point-of-sale payment solution for consumers, merchant commerce solutions, and a consumer-focused app. The firm generates its revenue from merchant networks, and through virtual card networks among others. Geographically, it generates a majority share of its revenue from the United States.

After a thorough review of the options trading surrounding Affirm Holdings, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Present Market Standing of Affirm Holdings

- With a trading volume of 5,104,081, the price of AFRM is up by 5.72%, reaching $43.51.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 28 days from now.

What The Experts Say On Affirm Holdings

5 market experts have recently issued ratings for this stock, with a consensus target price of $51.4.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from BTIG upgraded its action to Buy with a price target of $68.

* In a cautious move, an analyst from RBC Capital downgraded its rating to Sector Perform, setting a price target of $46.

* In a positive move, an analyst from Morgan Stanley has upgraded their rating to Equal-Weight and adjusted the price target to $37.

* An analyst from Barclays has decided to maintain their Overweight rating on Affirm Holdings, which currently sits at a price target of $54.

* In a cautious move, an analyst from Susquehanna downgraded its rating to Positive, setting a price target of $52.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Affirm Holdings with Benzinga Pro for real-time alerts.