Whales with a lot of money to spend have taken a noticeably bearish stance on Eli Lilly.

Looking at options history for Eli Lilly (NYSE:LLY) we detected 33 trades.

If we consider the specifics of each trade, it is accurate to state that 39% of the investors opened trades with bullish expectations and 54% with bearish.

From the overall spotted trades, 8 are puts, for a total amount of $716,130 and 25, calls, for a total amount of $2,183,235.

Predicted Price Range

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $600.0 to $1140.0 for Eli Lilly over the recent three months.

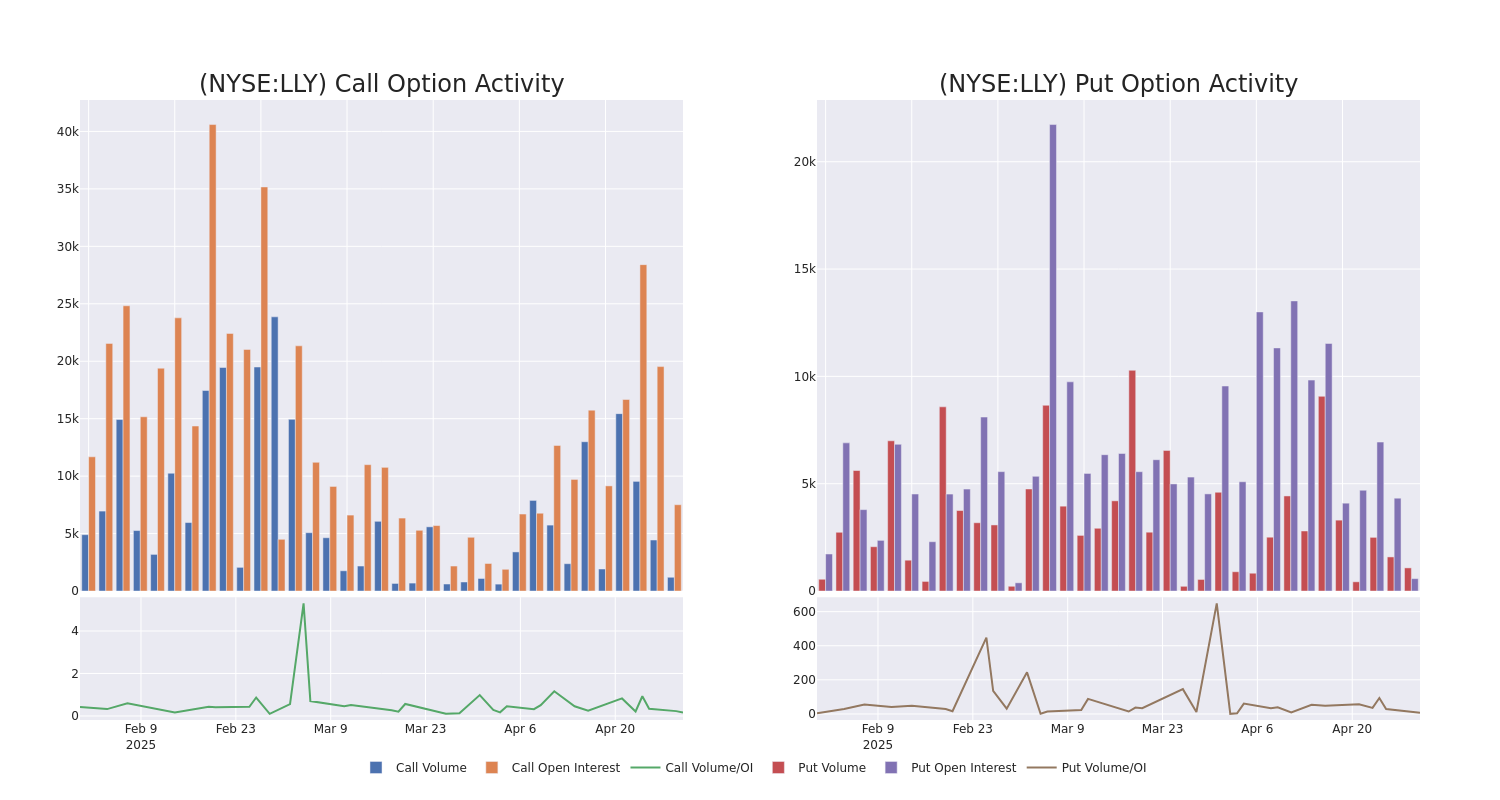

Volume & Open Interest Development

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Eli Lilly’s options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Eli Lilly’s significant trades, within a strike price range of $600.0 to $1140.0, over the past month.

Eli Lilly 30-Day Option Volume & Interest Snapshot

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| LLY | CALL | TRADE | BEARISH | 07/18/25 | $83.05 | $81.9 | $81.9 | $850.00 | $327.6K | 297 | 149 |

| LLY | CALL | TRADE | NEUTRAL | 05/09/25 | $30.05 | $27.5 | $29.0 | $885.00 | $290.0K | 257 | 113 |

| LLY | CALL | TRADE | BEARISH | 07/18/25 | $83.3 | $82.2 | $82.2 | $850.00 | $238.3K | 297 | 79 |

| LLY | PUT | TRADE | BEARISH | 09/19/25 | $82.45 | $80.65 | $81.8 | $900.00 | $204.5K | 79 | 25 |

| LLY | CALL | TRADE | BEARISH | 07/18/25 | $87.15 | $85.6 | $85.6 | $850.00 | $162.6K | 297 | 209 |

About Eli Lilly

Eli Lilly is a drug firm with a focus on neuroscience, cardiometabolic, cancer, and immunology. Lilly’s key products include Verzenio for cancer; Mounjaro, Zepbound, Jardiance, Trulicity, Humalog, and Humulin for cardiometabolic; and Taltz and Olumiant for immunology.

Having examined the options trading patterns of Eli Lilly, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Present Market Standing of Eli Lilly

- With a trading volume of 730,787, the price of LLY is down by -0.47%, reaching $881.04.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 1 days from now.

Professional Analyst Ratings for Eli Lilly

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $923.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from Guggenheim persists with their Buy rating on Eli Lilly, maintaining a target price of $928.

* An analyst from HSBC has revised its rating downward to Reduce, adjusting the price target to $700.

* An analyst from Cantor Fitzgerald downgraded its action to Overweight with a price target of $975.

* Showing optimism, an analyst from Goldman Sachs upgrades its rating to Buy with a revised price target of $888.

* Consistent in their evaluation, an analyst from Morgan Stanley keeps a Overweight rating on Eli Lilly with a target price of $1124.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Eli Lilly options trades with real-time alerts from Benzinga Pro.