Even with the Federal Reserve poised to end all hopes of a March rate cut on Wednesday, the S&P 500 index remains at record levels.

Adam Kobeissi, author of The Kobeissi Letter on X said on Tuesday: “Even as three interest rate cuts were removed from market forecasts, the S&P 500 is just 10 points away from a new all time high.”

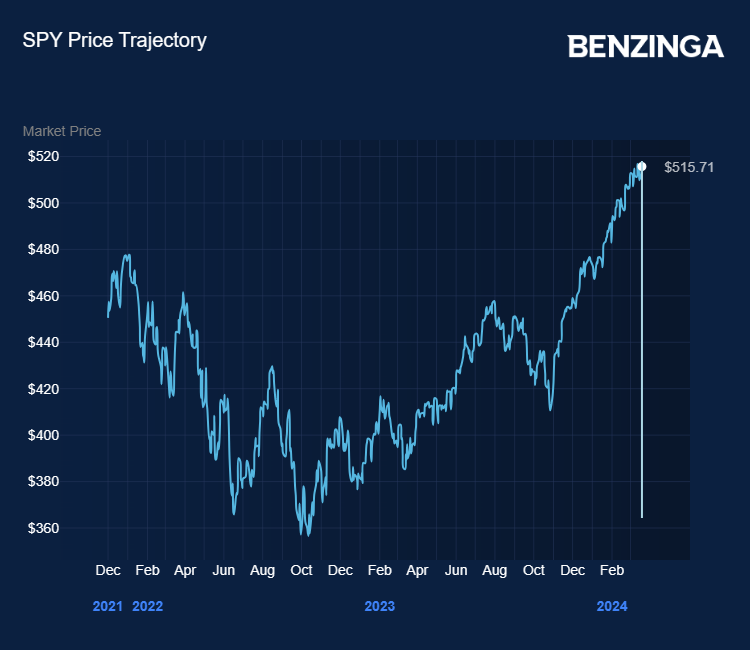

Why has there been such a disconnect between interest rates and equity markets? Let’s look at the evidence in the chart of the SPDR S&P 500 ETF (NYSE:SPY) the exchange traded fund that closely tracks the percentage performance of the U.S. large-cap index.

Also Read: Microsoft’s AI Ambitions Propel DeepMind Co-Founder To Leadership Role

Interest Rates Vs. Equity Markets

Note that through 2022 as the Fed was aggressively raising interest rates, the index moved lower — barring the occasional bounce higher.

While the Fed was still raising rates in 2023, it was doing so at a less aggressive pace, and investors sensed the central bank was nearing the end of its hiking cycle and pushed the index higher.

The Fed’s final hike came in July 2023, but it retained a hawkish tone at subsequent meetings and investors became weary of pushing against the tide, and between late July and late October, the index fell nearly 10%.

Then came the long-awaited pivot. The first signal that the inclination towards hiking rates might be waning came in late October, as inflation fell by more than expected and comments from Fed Chair Jerome Powell were interpreted as dovish.

The came the October/November Fed meeting, where rates were held steady for a second-consecutive month and markets began to price in rate cuts during the first half of 2024. At the loftiest of expectations, some economists were forecasting up to six rate cuts this year.

But the market hasn’t stopped moving higher, even as hopes of a rate cut at Wednesday’s meeting are off the table. The Fed has become more cautious in recent weeks as the last few percentage points of inflation become the toughest to budge. Now some economists believe we’ll be lucky to see three rate cuts this year.

Historic AI Strength?

Kobeissi puts the market’s resilience down to one thing: “The strength of AI hype is truly historic,” he says.

“Over the short run you’re going to see AI keep pushing stocks higher. But as you move further out all eyes are on the Fed.

“The Fed ‘pivot’ speech of December now seems premature. Markets are guiding three interest rate cuts, if we’re lucky,” he added.

But it’s not just about hype. With earnings season for the final quarter of 2023 all but over, the S&P 500 index barely took a backward step — a couple of slight glitches, maybe.

Earnings were, on the whole, positive with three-quarters of companies on the S&P 500 reporting upside earnings surprises, and only 10% issuing negative guidance for the year ahead.

“The era of lower quality growth where cheap capital and globalization contributed to margins is over. Now it’s time for sustainable efficiency and productivity gains supported by automation and AI,” said analysts at Bank of America at the start of earnings season.

This has been borne out by some of the biggest tech and AI names. Nvidia Corporation (NASDAQ:NVDA), as Benzinga reported earlier this month, added an incredible $1 trillion to its market cap in the first 67 days of 2024.

This was not based on hype, but on solid performance as the company reported stellar earnings and guidance. However, at 73x the company’s price/earnings ratio could be starting to look a little lofty.

In fact, most of the Magnificent Seven stocks, including Amazon.com Inc (NASDAQ:AMZN) and Meta Platforms Inc (NASDAQ:META) reported stronger than expected earnings.

Tesla Inc (NASDAQ:TSLA) has been a rare failure in the sector, as the electric vehicle maker reported slowing demand for its cars.

The Invesco QQQ Trust (NYSE:QQQ), an exchange traded fund that most closely follows the big tech stocks, has gained nearly 13% so far in 2024. This compares with 8.5% on the SPY.

Now Read: Nvidia Blazes Trail For 3 Further Phases Of AI Investment Opportunity, Says Analyst

Image created using artificial intelligence with Midjourney.