The most oversold stocks in the materials sector presents an opportunity to buy into undervalued companies.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

Here’s the latest list of major oversold players in this sector, having an RSI near or below 30.

Hongli Group Inc (NASDAQ:HLP)

- On Oct. 6, Hongli Group announced compliance with Nasdaq minimum bid price requirement. The company’s stock fell around 46% over the past month and has a 52-week low of $0.61.

- RSI Value: 24.9

- HLP Price Action: Shares of Hongli Group fell 5.4% to close at $0.73 on Thursday.

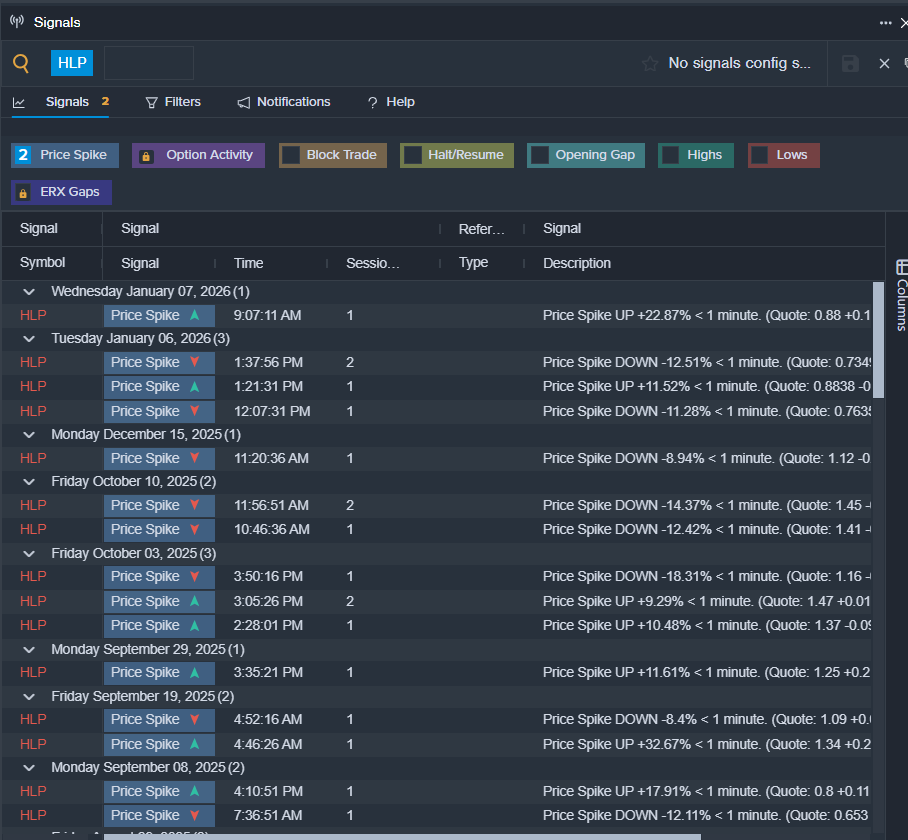

- Benzinga Pro’s signals feature notified of a potential breakout in HLP shares.

Origin Materials Inc (NASDAQ:ORGN)

- On Nov. 13, Origin Materials reported quarterly losses of 11 cents per share, versus year-ago losses of 26 cents per share. John Bissell, Origin CEO and Co-Founder said. “Today, we are announcing financing that strengthens our balance sheet and provides access to additional capital that can be staged according to our manufacturing capacity build-out. This financing fuels the scale-up of PET cap production to serve forthcoming volume orders pursuant to customer qualification.” The company’s stock fell around 52% over the past month and has a 52-week low of $0.19.

- RSI Value: 27

- ORGN Price Action: Shares of Origin Materials fell 6.7% to close at $0.21 on Thursday.

- Benzinga Pro’s charting tool helped identify the trend in ORGN stock.

BZ Edge Rankings: Find out where other stocks stand—explore the full comparison now.

Photo via Shutterstock

![[Aggregator] Downloaded image for imported item #471294](https://tipsforinvesting.com/wp-content/uploads/2026/01/Martin-Marietta-Materials.jpeg)