The most oversold stocks in the consumer discretionary sector presents an opportunity to buy into undervalued companies.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

Here’s the latest list of major oversold players in this sector, having an RSI near or below 30.

ODP Corp (NASDAQ:ODP)

- On Aug. 7, ODP reported worse-than-expected second-quarter financial results and cut its FY24 guidance. “While we are pacing below our prior expectations for the year, we are not standing still. We’re taking actions to improve our top-line trajectory and we remain focused on capturing the long-term opportunities derived by our strong value proposition, solid balance sheet, and flexible foundation,” said Gerry Smith, chief executive officer of ODP. The company’s stock fell around 33% over the past five days and has a 52-week low of $23.69.

- RSI Value: 21.13

- ODP Price Action: Shares of ODP fell 2.5% to close at $25.52 on Friday.

- Benzinga Pro’s real-time newsfeed alerted to latest ODP news.

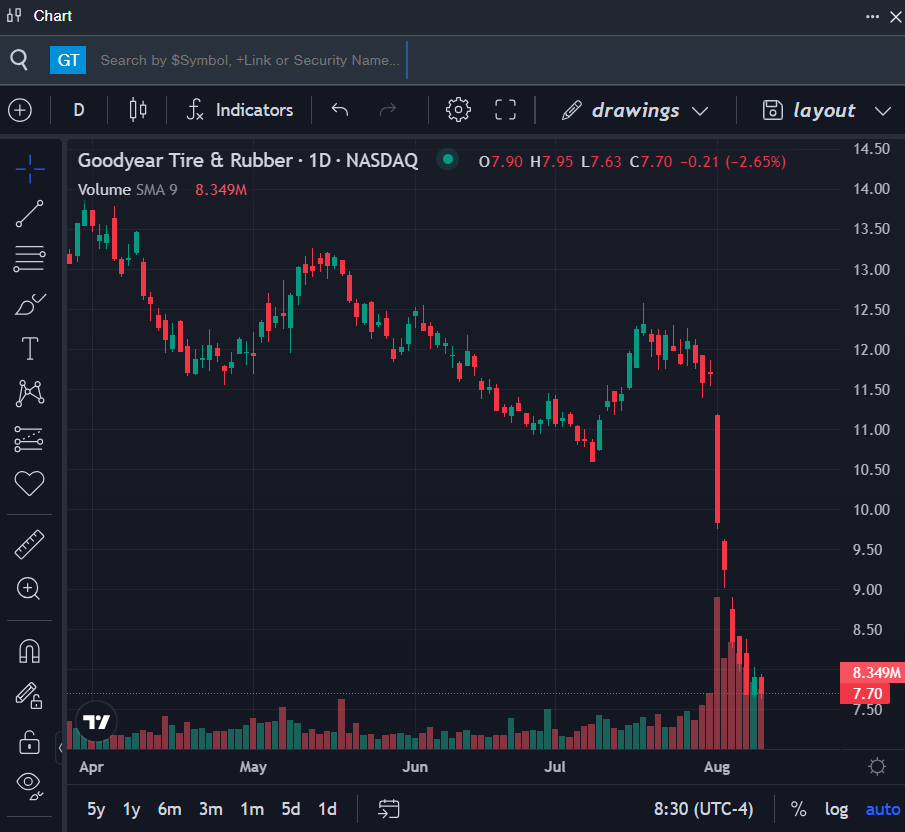

Goodyear Tire & Rubber Co (NASDAQ:GT)

- On July 31, Goodyear Tire & Rubber reported mixed quarterly financial results. “We demonstrated clear progress on our Goodyear Forward plan in the second quarter, achieving significant margin expansion and securing a definitive agreement to sell our Off-the-Road business,” said Chief Executive Officer and President Mark Stewart. The company’s stock fell around 32% over the past month. It has a 52-week low of $7.63.

- RSI Value: 22.49

- GT Price Action: Shares of Goodyear Tire fell 2.7% to close at $7.70 on Friday.

- Benzinga Pro’s charting tool helped identify the trend in GT stock.

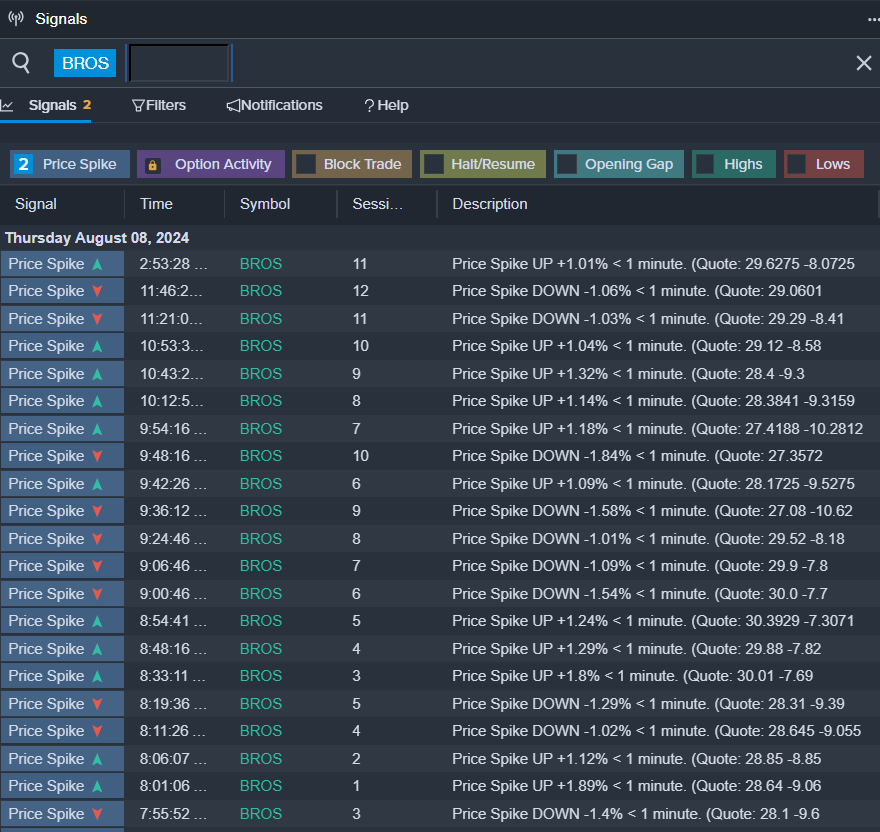

Dutch Bros Inc (NYSE:BROS)

- On Aug. 7, Dutch Bros reported quarterly earnings of 19 cents per share which beat the analyst consensus estimate of 13 cents by 46.15%. “Our quarterly performance demonstrates the long runway ahead for Dutch Bros as we once again delivered strong top-line and profitability growth. Revenue rose 30%, including a 4.1% increase in system same-shop sales, and was underpinned by excellent margin flow through. With strong results 2024 to date despite the volatile consumer backdrop and expectations for a robust second half to the year, we are pleased to be raising our annual guidance,” said Christine Barone, CEO of Dutch Bros. The company’s shares fell around 28% over the past month and has a 52-week low of $22.66.

- RSI Value: 25.27

- BROS Price Action: Shares of Dutch Bros fell 2.4% to close at $29.49 on Friday.

- Benzinga Pro’s signals feature notified of a potential breakout in BROS shares.

Read Next: