The most oversold stocks in the materials sector presents an opportunity to buy into undervalued companies.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

Here’s the latest list of major oversold players in this sector, having an RSI near or below 30.

Westlake Chemical Partners LP (NYSE:WLKP)

- On Aug. 5, Westlake Chemical posted weaker-than-expected quarterly results. “The Partnership’s second quarter financial results improved significantly from the first quarter of 2025 due to higher production and sales volume at our Petro 1 facility as a result of fewer production days lost to the turnaround that began at the end of January and lasted until early April. While there were some lingering impacts to distributable cash flow in the second quarter from the extension of the turnaround into April, primarily in the form of elevated maintenance capital expenditures, this was not unexpected and should not re-occur at such a high level in future quarters,” said Jean-Marc Gilson, President and Chief Executive Officer. The company’s stock fell around 5% over the past month and has a 52-week low of $20.96.

- RSI Value: 26.7

- WLKP Price Action: Shares of Westlake Chemical Partners closed at $21.03 on Tuesday.

- Edge Stock Ratings: 23.81 Momentum score with Value at 81.96.

Aptargroup Inc (NYSE:ATR)

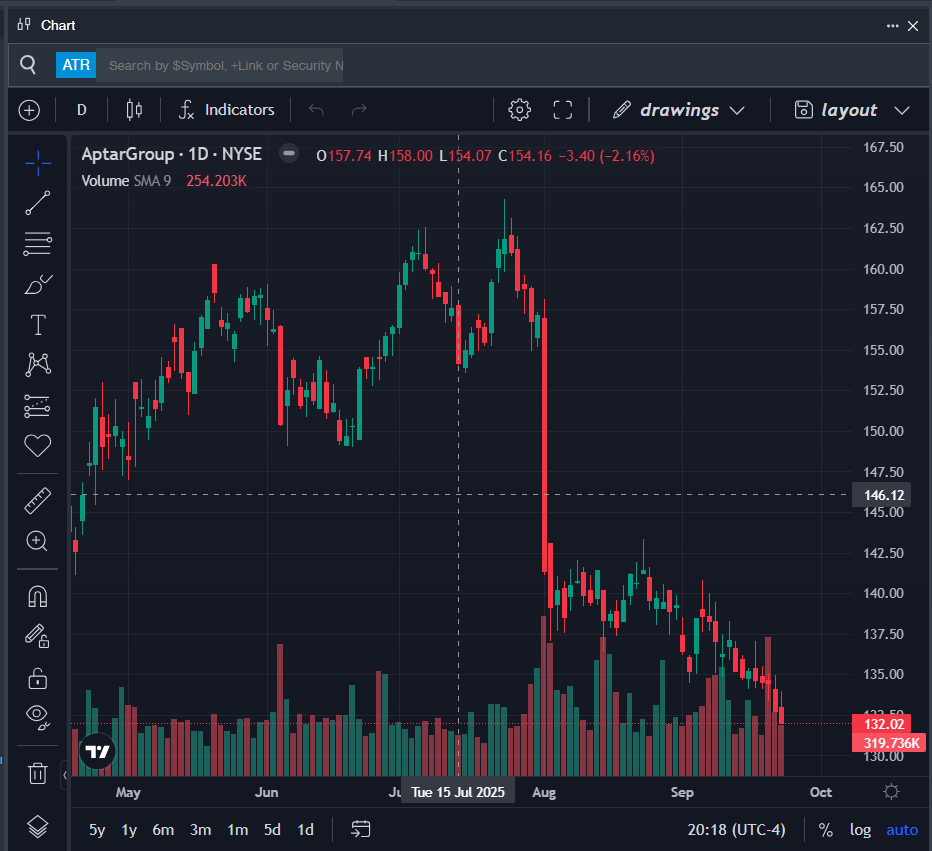

- On July 31, AptarGroup reported second-quarter financial results and issued third-quarter adjusted EPS guidance below estimates. “Each of our segments contributed positively to our second quarter results and each expanded their adjusted EBITDA margins. Our Pharma and Closures segments drove the growth through increased volumes and sales of higher value products. We also returned $100 million to shareholders through dividends and share repurchases in the quarter, bringing the total to $210 million in the first half of the year,” said Stephan B. Tanda, Aptar President and CEO. The company’s stock fell around 5% over the past month and has a 52-week low of $130.85.

- RSI Value: 28.5

- ATR Price Action: Shares of Aptargroup slipped 0.5% to close at $132.02 on Tuesday.

- Benzinga Pro’s charting tool helped identify the trend in ATR stock.

Graphic Packaging Holding Co (NYSE:GPK)

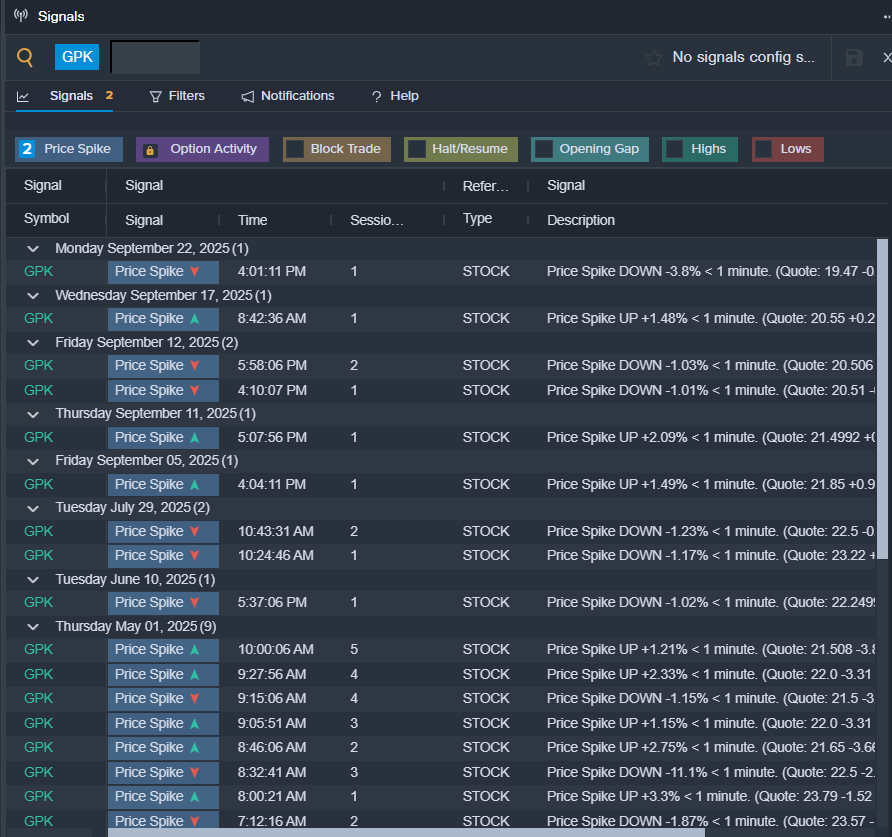

- On Sept. 17, Wells Fargo analyst Gabe Hajde maintained Graphic Packaging Holding with an Equal-Weight rating and lowered the price target from $23 to $20. The company’s stock fell around 16% over the past month and has a 52-week low of $19.06.

- RSI Value: 28.7

- GPK Price Action: Shares of Graphic Packaging fell 2% to close at $19.08 on Tuesday.

- Benzinga Pro’s signals feature notified of a potential breakout in GPK shares.

Learn more about BZ Edge Rankings—click to see scores for other stocks in the sector and see how they compare.

Read This Next:

Photo via Shutterstock