The most oversold stocks in the consumer staples sector presents an opportunity to buy into undervalued companies.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

Here’s the latest list of major oversold players in this sector, having an RSI near or below 30.

Constellation Brands Inc (NYSE:STZ)

- On June 2, Constellation Brands announced delivery of notices of redemption for 4.75% senior notes due 2025 and 5.00% senior notes due 2026. The company’s stock fell around 9% over the past month and has a 52-week low of $160.46.

- RSI Value: 26.8

- STZ Price Action: Shares of Constellation fell 3.6% to close at $170.60 on Thursday.

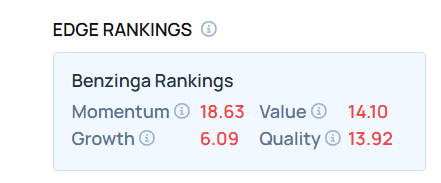

- Edge Stock Ratings: 18.63 Momentum score with Value at 14.10.

Coca-Cola Consolidated Inc (NASDAQ:COKE)

- On May 15, Coca-Cola Consolidated announced a $90 million investment in Columbus facility. “The investment we’ve made here in Columbus is evidence of our focus on growth in Columbus,” said Sam Meiner, VP, Mid-West Market Unit at Coca-Cola Consolidated. “This commitment to our teammates and production capabilities is a long-term dedication to improving how we serve the world’s best brands and flavors to our communities and the people of Ohio.” The company’s stock fell around 10% over the past month and has a 52-week low of $96.60.

- RSI Value: 25.8

- COKE Price Action: Shares of Coca-Cola Consolidated fell 1.4% to close at $106.17 on Thursday.

- Benzinga Pro’s charting tool helped identify the trend in COKE stock.

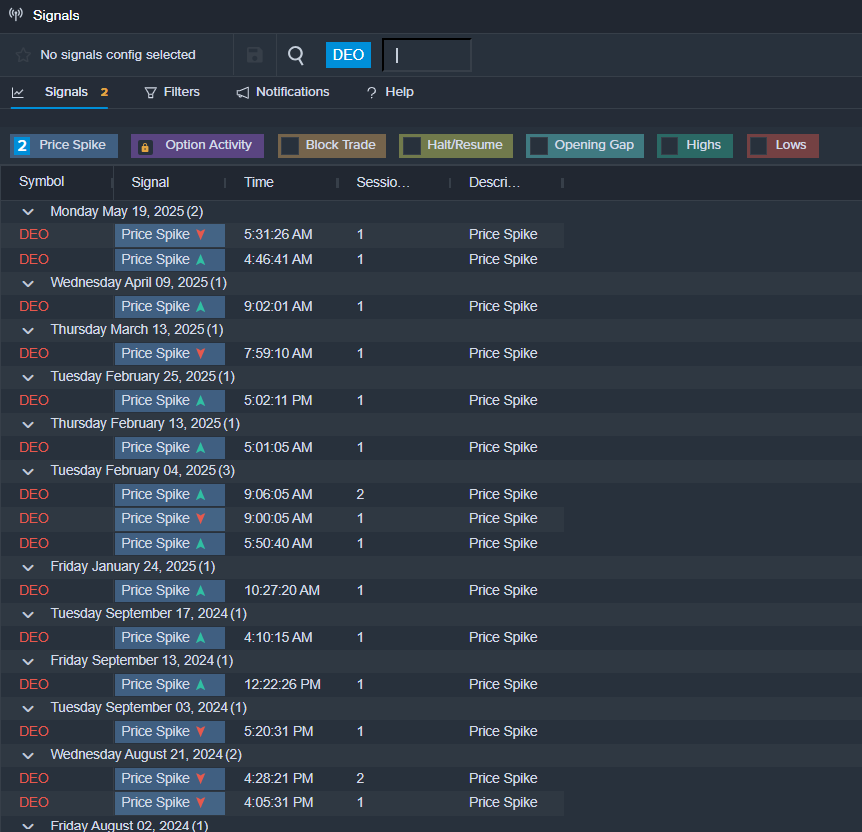

Diageo PLC (NYSE:DEO)

- On May 19, Diageo reported a third-quarter fiscal 2025 trading update that showed steady growth in organic net sales and progress on its operational transformation efforts. The maker of Smirnoff and Guinness posted $4.4 billion in net sales for the quarter ended March 31, marking a 2.9% increase year-over-year. Organic net sales rose 5.9%, driven by stronger pricing and shipment volumes. The company’s stock fell around 8% over the past month and has a 52-week low of $100.72.

- RSI Value: 29

- DEO Ltd Price Action: Shares of Diageo fell 5.1% to close at $105.20 on Thursday.

- Benzinga Pro’s signals feature notified of a potential breakout in DEO shares.

Learn more about BZ Edge Rankings—click to see scores for other stocks in the sector and see how they compare.

Read This Next:

Photo via Shutterstock